The Class I railroads are still far under the employment levels needed to offer exceptional rail service, let alone grow network capability, an attorney representing seven freight rail unions argued in a Monday filing to the Surface Transportation Board.

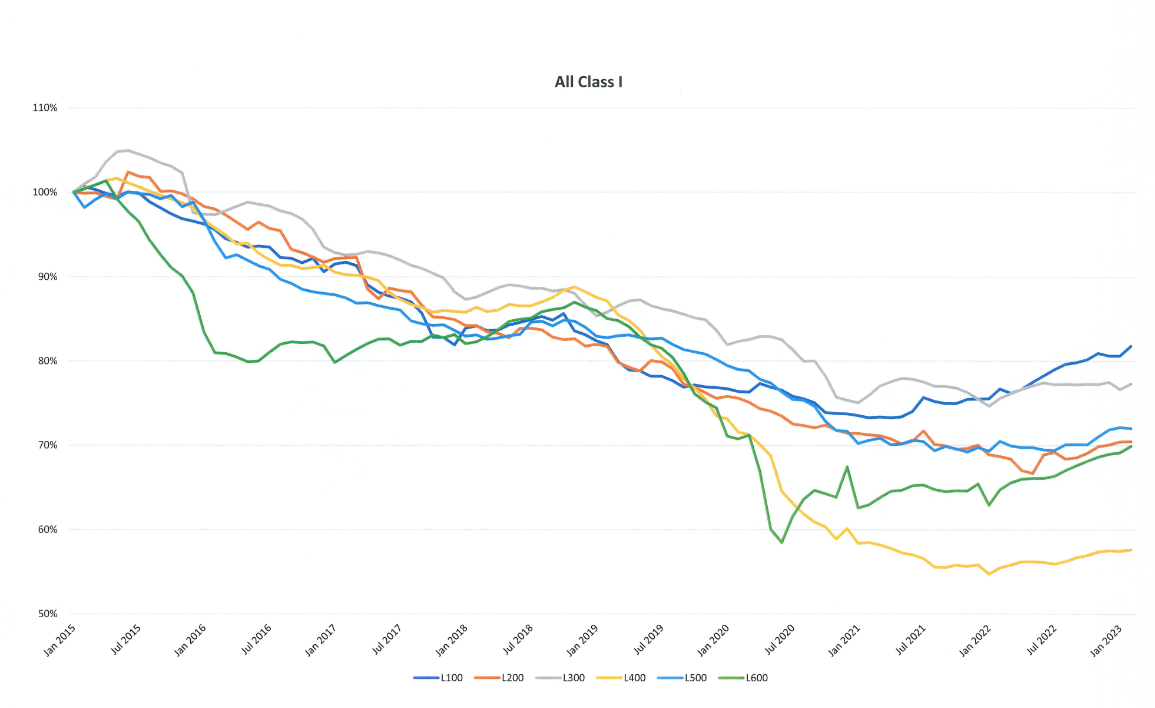

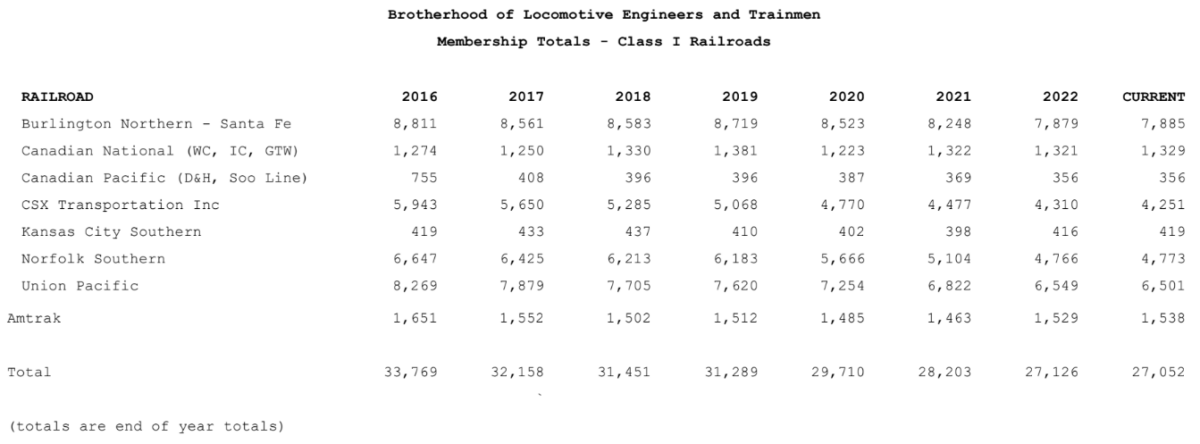

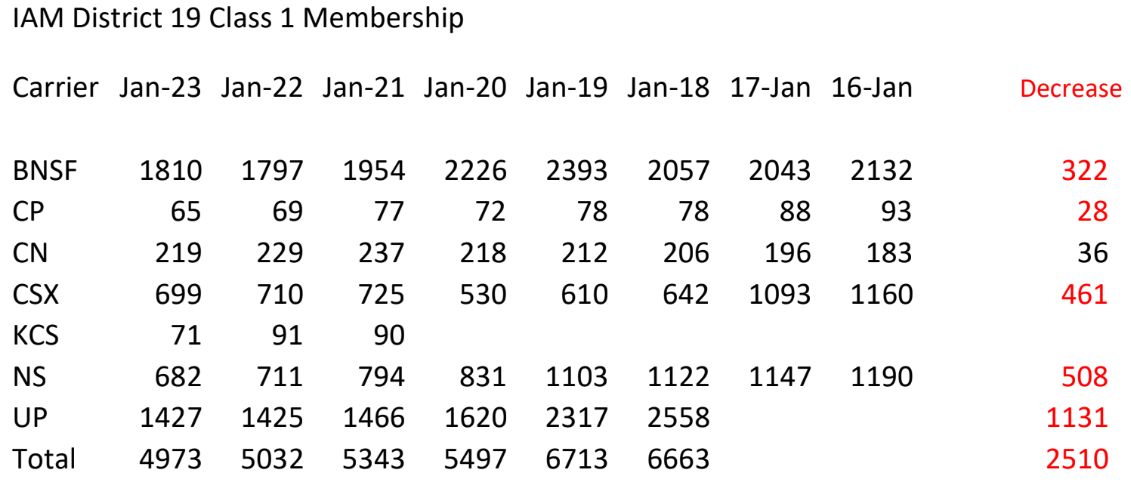

Although the railroads say employment levels have grown since last 12 months, head count levels are well below 2019’s pre-pandemic levels if taking a look at the membership data of different craft unions, in line with attorney Richard S. Edelman on behalf of the unions.

“A whole picture of employment data shows that the Class I’s have only imperceptibly moved the needle on increasing their workforces,” Edelman wrote. “As the information supplied by the Unions show, the web employment numbers indicate weak or surface efforts to provide the impression of attempts to extend employment, and suggest efforts to placate critics by giving the looks of motion. The statements of the executives and the general public relations statements of the railroads are negligent at best, and intentionally misleading at worst.”

Edelman represents the next unions: the Brotherhood of Maintenance of Way – Employes Division, which is affiliated with the International Brotherhood of Teamsters; Brotherhood of Railroad Signalmen; International Association of Boilermakers; International Association of Machinists and Aerospace Staff District #19; International Association of Sheet Metal, Air, Rail and Transportation Staff – Mechanical Division; National Conference of Firemen and Oilers, 32BJ/SEIU; and the Transport Staff Union of America.

The aim of the groups’ submission to STB was to update the board on whether changes in employment levels have led to improvements in rail service, and the filing was submitted in an ongoing proceeding meant to watch the railroads’ service. During STB’s April 2022 public hearing on rail service, some witnesses, including Edelman, suggested that railroad head count reductions were the results of precision scheduled railroading, a way that sought to streamline operations.

In keeping with employment data provided by the Class I railroads to STB, total head count inside the U.S. operations of the Class I railroads in April was the very best it has been since May 2020, the beginning of the COVID-19 pandemic.

April’s headcount was 121,391 employees, up from 115,510 people in April 2022 and slightly below a five-year average of about 124,208 people, in line with STB data.

But membership data from the assorted craft unions, in addition to data provided by the Labor Bureau Inc., a labor economics and union finance consulting firm, higher reflect nuances in recent employment trends, the unions via Edelman argued, saying that’s since the STB data gets reported by department and never by craft.

While STB’s employment data shows increases in head count levels, the unions’ data shows that the expansion rate persists to be uneven among the many crafts. Consequently, the labor shortages prevent the rail network from fully recovering, the unions argued.

STB’s employment data also excludes the speed of attrition on the railroads, which may also contribute to the unions’ perception that labor shortages are still ongoing, Edelman said.

Along with head count data, the unions’ filing also includes documents detailing instances during which union members working for individual railroads determined that track or infrastructure wasn’t being adequately maintained.

The unions via Edelman also pointed to other transportation providers, akin to Amtrak and the airline industry, arguing that they’ve been in a position to boost their ranks to exceed pre-pandemic levels.

“That Amtrak has been in a position to increase employment shows that the assertion that the railroad industry presents peculiar recruitment problems is only a false façade over a scarcity of desire to extend employment,” Edelman said.

A comparison with the airline industry can also be noteworthy because that industry also faces similar working conditions akin to irregular schedules and on-call work: “There isn’t a reason railroads can’t fill positions while the airlines can, apart from lack of will and refusal to answer reduced supply as a market actor should react — by aggressive outreach and economic enticements,” Edelman said.

To bolster rail service, Edelman called upon STB to press Congress for assist in proceeding with some rail shipper-prescribed remedies, akin to clarifying what defines adequate rail service in line with the railroads’ common carrier obligation, a federal guideline that binds the railroads to offer rail service.

Clarifying that definition may encourage the railroads to take more steps to bolster rail service — including filling the ranks of craft employees as a option to ensure efficient operations, in line with Edelman.

The railroads should comply with STB’s efforts to bolster rail service since the board historically, in addition to STB’s predecessor, the Interstate Commerce Commission, had granted the Class I railroads more market power by approving past mega-mergers under the expectation that those mergers would ultimately profit shippers, said Edelman, arguing some extent previously expressed by some shippers.

“Having reaped the advantages of Board approval of their creation, the railroads are in no position to object to the Board taking steps to make sure that they comply with their statutory obligations, and structure themselves (including as to staffing), to offer the general public transportation advantages they represented would flow from Board approval of the transactions that created the mega- carriers and the industry that exists today,” Edelman said.

Subscribe to FreightWaves’ e-newsletters and get the newest insights on freight right in your inbox

.

Related links:

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.