Exactly one 12 months ago, SONAR’s ocean container bookings data revealed that U.S. import demand for containerized goods was dropping off a cliff, and while that very same bookings data remains to be trending right alongside 2019 levels (as we forecast), the weakening global macroeconomic backdrop is constant so as to add further downside risks to volumes. With U.S. importers likely as cautious as ever before in bringing in recent volumes in the course of the second half of 2023, it’s increasingly likely that U.S. import demand is again positioned for brand new declines and destined to seek out a brand new bottom within the second half.

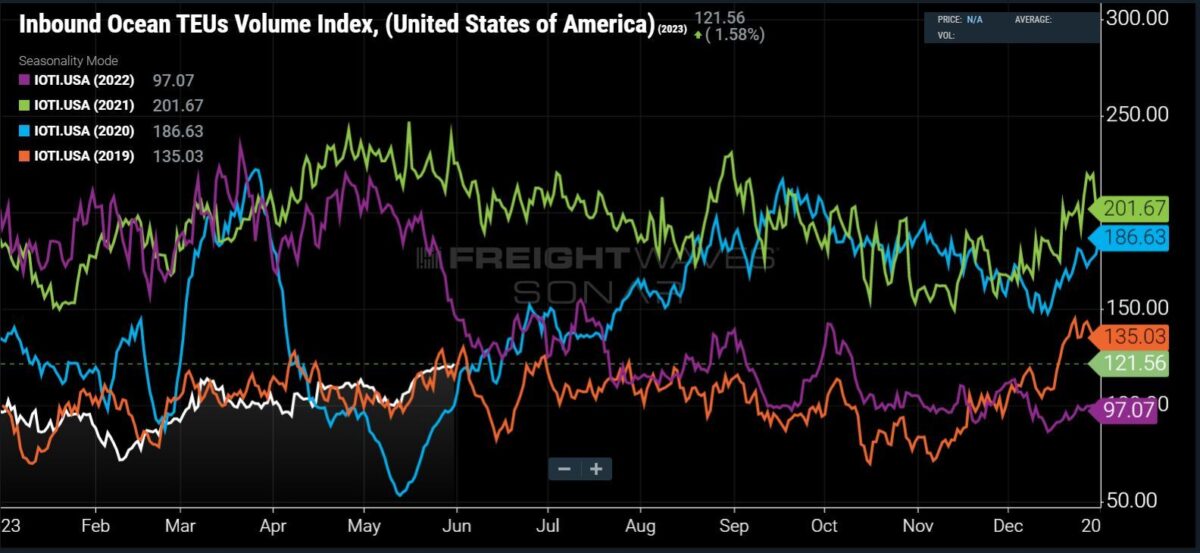

Within the chart above, the most recent ocean container bookings data from SONAR reveals that U.S. containerized import volumes have reached an eight-month high. While this recent boost is a welcome signal to anyone hoping for a rebound in U.S. import volumes, it may even be misleading unless viewed within the context of the past 4 years of U.S. containerized import volumes, which we’ve within the chart below.

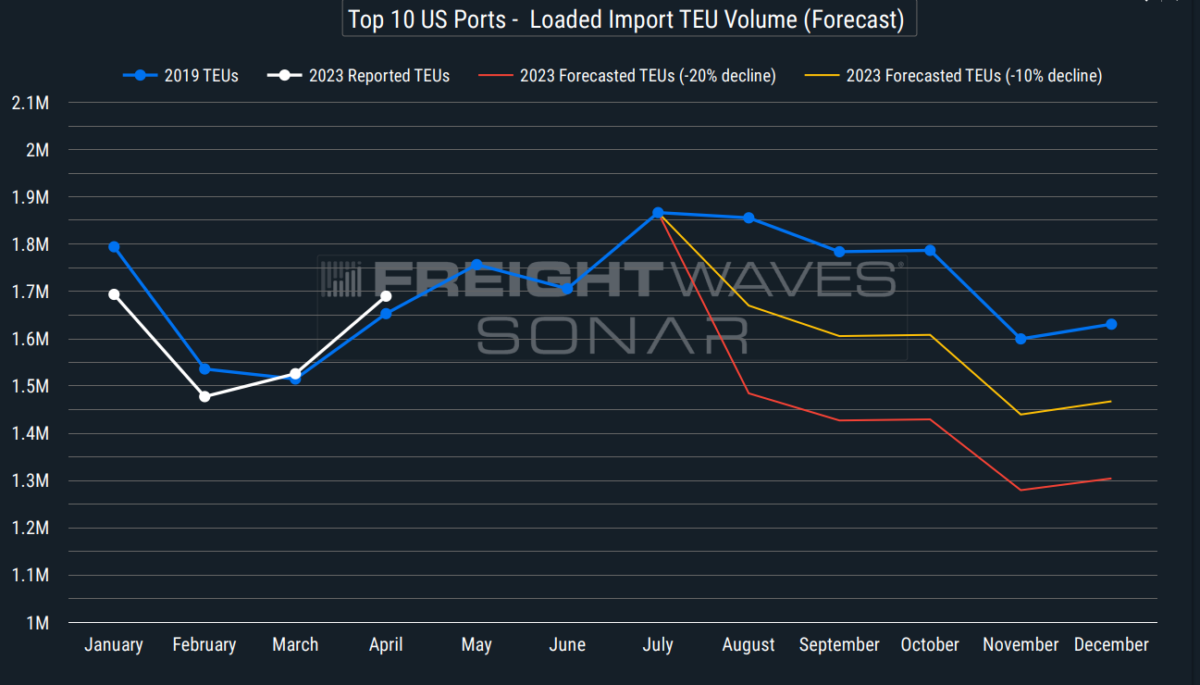

As we previously forecast, ocean container bookings in the primary half of 2023 (white line) have continued trending right alongside 2019 levels (orange line). This is predicted to proceed through early Q3, at which point we are going to likely begin to see a detaching from 2019 levels to the downside, with 2023 volumes dropping noticeably below. From there, U.S. containerized import volumes will begin retesting the lows reached during Chinese Recent Yr of this 12 months, dropping below those levels during late Q3/early Q4 to seek out a brand new bottom, ultimately leading to a big drop of 10% to twenty% below second-half 2019 levels. Below is a chart of what that decline of 10% (orange) to twenty% (red) in monthly loaded import TEUs would appear like across the Top 10 U.S. ports.

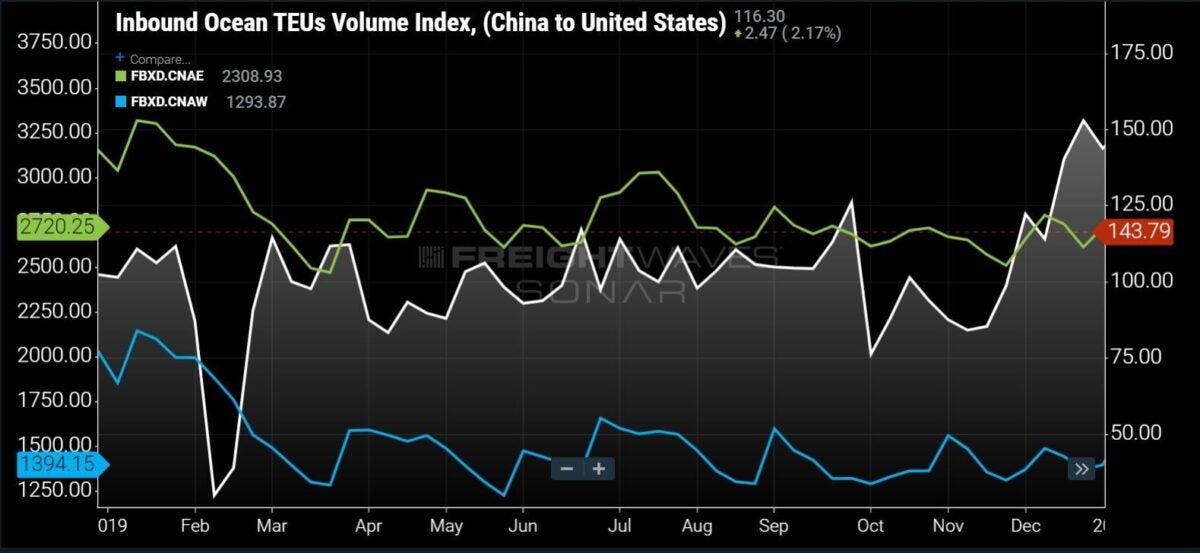

With our bearish projections for U.S. containerized import volumes, additionally it is likely that ocean container spot prices could reach a brand new bottom as well. Within the chart below, we will use 2019 container volumes from China to the U.S. as a proxy to raised understand how container spot rates are prone to behave moving forward through the top of 2023. With volumes remaining relatively flat throughout 2019 from China to the U.S., with no noticeable uptick during peak season, ocean container spot rates remained between $1,250-$1,500 from China/East Asia to the U.S. West Coast and $2,500-$3,000 from China/East Asia to the U.S. East Coast for everything of the 12 months (after the initial Q1 declines), in line with the Freightos Baltic Index.

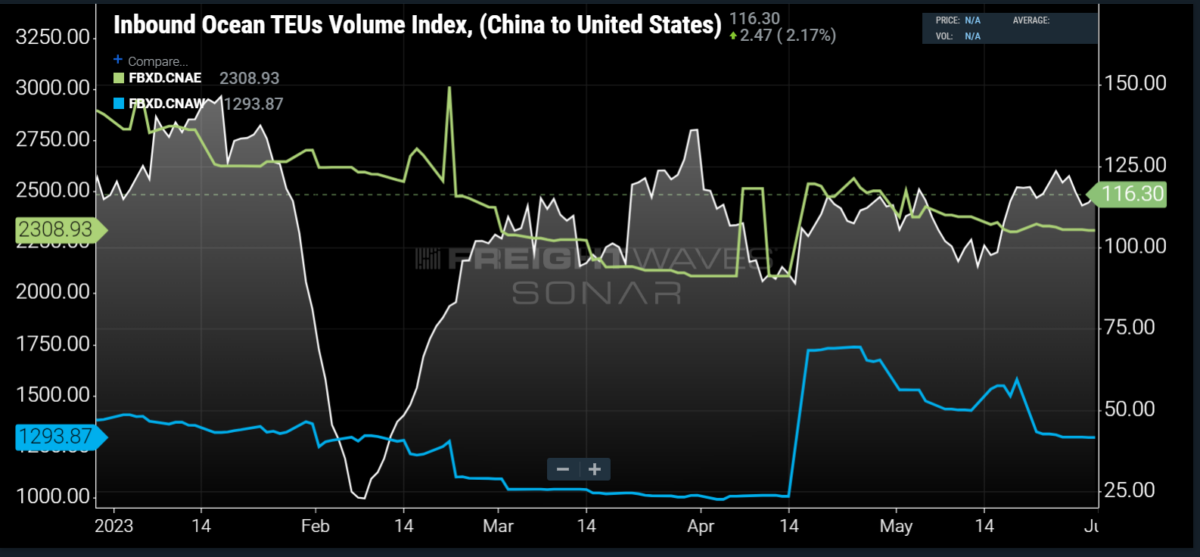

If volumes indeed decline and follow our projections for the second half of 2023, then it is feasible that ocean container spot rates could reach recent lows as well. As we see within the chart below, the ground that has been established to date in 2023 puts ocean container spot rates currently between $1,000 and $1,700 from China/East Asia to the U.S. West Coast and $2,000-$2,550 from China/East Asia to the U.S. East Coast, in line with the Freightos Baltic Index. So, if volumes were to stay relatively flat for the rest of 2023, then it is affordable to assume that ocean container spot rates could behave similarly to the best way that they behaved within the second half of 2019. Nevertheless, given our projected declines, unless ocean carriers are truly in a position to effectively control capability on the provision side, the downward pressure on spot rates will likely be immense, and it is extremely likely that a brand new floor could possibly be present in ocean container spot rates as well.

From the trade war to COVID to record high freight rates to the backside of the “bullwhip effect” with inventories at major U.S. importers remaining high, and now, a shift in consumer spending toward necessities fairly than discretionary goods, U.S. importers are likely going to be as cautious as they’ve ever been in bringing in recent volumes within the second half. This reality, coupled with the weakening global macroeconomic backdrop, is just adding to the downside risks to volumes that now exist. While it will not be a proverbial “cliff,” it’s increasingly likely that U.S. import demand is once more positioned for brand new declines, and destined to seek out a brand new bottom within the second half of 2023.

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/F5ERKB2GSZC7DOSER4SCJDZVSQ.jpg)