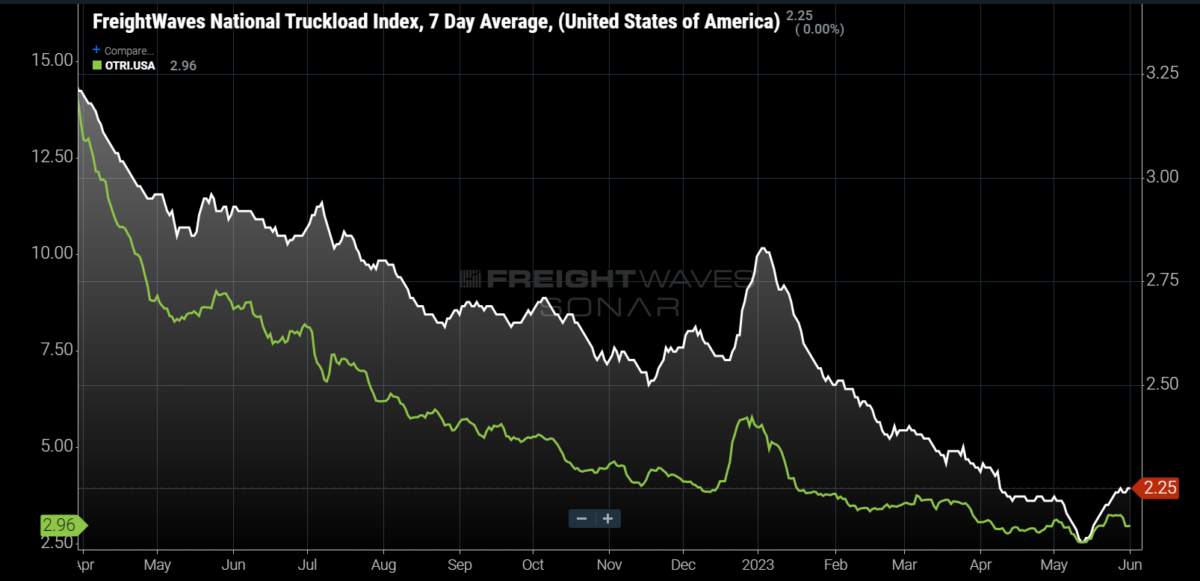

Chart of the Week: National Truckload Index, Outbound Tender Rejection Index – USA SONAR: NTI.USA, OTRI.USA

Truckload spot rates increased marginally in comparison with month-ago levels while tender rejection rates barely moved during the last two weeks of May, providing little hope to transportation providers that capability has corrected noticeably.

The National Truckload Index (NTI), which measures average spot rates for dry van loads moving greater than 250 miles nationwide, did jump significantly compared to mid-May levels, but was only up 3 cents per mile (1%) from where it began the month.

The national Outbound Tender Rejection Index (OTRI), which measures how often carriers turn down load requests from their contract customers, only barely moved back over 3% for a couple of days at the tip of the month — values under 4% are indicative of extremely soft/loose environments.

To place this into perspective, capability tends to tighten around Memorial Day, pushing rejection and spot rates higher. Each indexes have shown increases on some level around the vacation since they were created from the years before and through the pandemic. The degrees of increase have varied widely.

Some inside the industry expected Roadcheck week and Memorial Day to be the inflection point that signaled the underside of the market was behind us. There’s some argument to be made taking a look at current trends that demand has potentially hit a floor. (The jury continues to be out on this one.) It continues to be too early to say that the market will probably be easier to navigate for transportation providers.

As mentioned in an earlier article, it is going to take some time for capability to exit the domestic truckload market. Carriers were handling 22% more freight at the tip of 2021 than they did this past week, in keeping with the Contract Load Accepted Volume Index (CLAV).

The CLAV measures loads that carriers accepted and moved for his or her contracted customers. Considering many carriers also had some percentage of their capability on the spot market, this number might be understated when it comes to their capabilities.

The CLAV is biased toward larger fleets with electronic tendering capabilities. This sector has largely been growing their fleet sizes by acquiring other operations which might be struggling — smaller operators have been feeling the brunt of this downturn probably the most. This process keeps capability out there longer.

So what happens next?

There are not any quick fixes to this market. revocations and exits aren’t sufficient in telling you with any precision when this market will tighten as smaller operators are wolfed up. Spot rates may also be deceiving as a result of increased demand for expedited or guaranteed services around holidays, which may increase rates without being true reductions to capability.

Rejection rates are far more revealing when it comes to when the market has began to change into sustainably tighter. If demand conditions remain stable (an enormous if) rejection rates should pulse higher around each holiday period.

July 4 is traditionally the summer peak when it comes to demand and spot market activity, although Labor Day took that title through the pandemic years. Spot and rejection rates are likely to be more conscious of that vacation than Memorial Day. If rejection rates stay below 4%, it is going to be an indication that conditions haven’t modified significantly.

In regards to the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that gives an interesting data point to explain the state of the freight markets. A chart is chosen from hundreds of potential charts on SONAR to assist participants visualize the freight market in real time. Each week a Market Expert will post a chart, together with commentary, survive the front page. After that, the Chart of the Week will probably be archived on FreightWaves.com for future reference.

SONAR aggregates data from a whole lot of sources, presenting the information in charts and maps and providing commentary on what freight market experts need to know concerning the industry in real time.

The FreightWaves data science and product teams are releasing latest datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.