FreightWaves’ “State of Freight” webinar for May offered little optimism that demand for cargo capability will return at any point this yr.

Craig Fuller, FreightWaves CEO and founder, said he doesn’t see any signs of a big uptick in demand for freight capability in 2023.

Listed below are five takeaways from the webinar:

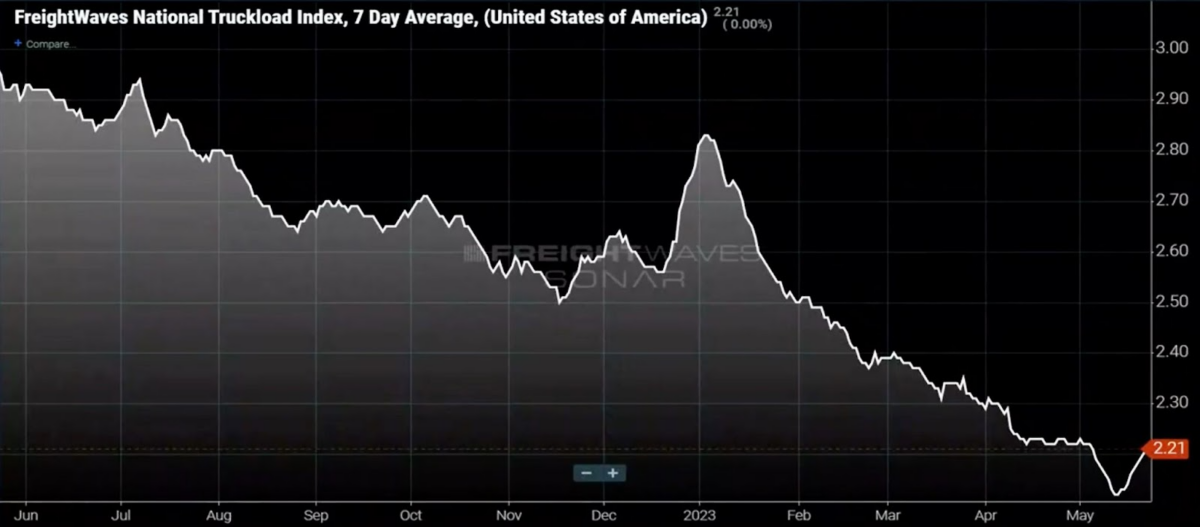

Spot rates not ‘out of the woods’ yet

May is often the time of yr when spot rates begin to trend upward resulting from seasonal demand, FreightWaves market expert Zach Strickland said, but that seems unlikely now.

“We’ve this backdrop of where we’ve come out of this time frame where capability has grown beyond any amount of demand that we could expect to occur this time of yr seasonally speaking,” Strickland said. “With reference to rate pressure, have we seen anything begin to sort of bubble up?”

Fuller said although current data from FreightWaves’ National Truckload Index (NTI.USA) is showing some slight upward trends within the spot rate, he doesn’t expect spot rates to proceed rising the remaining of the yr.

The National Truckload Index shows spot rates currently hovering around $2.21 per mile, while linehaul spot rates (NTIL.USA) are around $1.59 per mile.

“It’s Roadcheck week, which implies lots of those independent owner-operators decided that they didn’t wish to cope with the headaches of being out on the road and having inspections and coping with that,” Fuller said. “I feel we will even probably see some upward pressure this week since it is a vacation week, an extended weekend, the weather is nice, and lots of truck drivers will stay out for this week as well.”

Fuller said although rates may not get much lower this yr, it doesn’t mean that trucking firms will bounce back anytime soon.

“The operating cost for trucking firms, taking fuel out of the equation, but taking a look at things like driver salaries, maintenance, equipment costs, operating costs for a fleet, has gone up as much as 30 cents a mile [since 2019],” Fuller said. “It might be that we’ve hit a bottom for rates; it doesn’t mean that we’re out of the woods.”

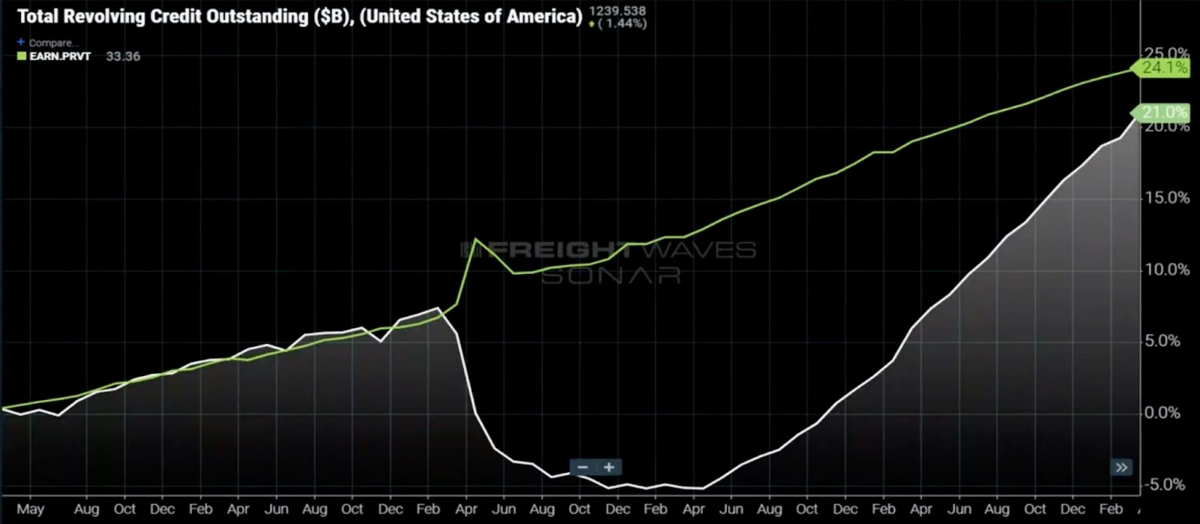

Consumers won’t rescue the freight market anytime soon

While some carrier executives have recently predicted that the second half of the yr might be higher than the primary, Fuller disagreed.

Consumers are facing financial stresses from lots of different directions, equivalent to student debt, less discretionary funds and inflation, Fuller said.

“I feel what we must always worry about within the freight market is what’s the story around the buyer, because they drive an unlimited amount of our economy, and can we consider that the buyer goes to proceed to spend the best way they’ve spent? I just don’t buy it,” Fuller said.

One in every of the most important burdens greater than 25 million Americans will face is the top of student loan forbearance, possibly as early as September. Fuller recently wrote about it in an article titled “An unusually terrible freight market may get loads worse.”

Student loan debt is in excess of $1 trillion, representing about 7% of U.S. GDP. The typical student loan payment is $393 per 30 days.

Most of the 25 million Americans who’ve deferred payments for student debt are ages 18-44, one of the vital necessary demographic groups that drive consumer spending.

“I feel what we’ve got to be concerned about is that what drives the freight economy is nice consumption,” Fuller said. “Goods are certainly one of those things that for those who take into consideration discretionary spending, it’s the stuff that you simply pull back on. That’s the stuff that basically matters by way of freight demand. I just can’t make the case that there are any really bullish signs within the second half.”

Equipment sales could go lower in 2023

Each Fuller and Strickland said they don’t consider that equipment sales have found a floor, with truck orders possibly going lower the remaining of the yr.

“I don’t think equipment sales have bottomed out, I feel lots of the conditions out there [lower demand for capacity] for a few of the carriers is comparatively latest, particularly for the larger fleets, or fleets that had lots of contracts,” Fuller said. “They really weren’t seeing significantly difficult conditions until now, February, March and April.”

Fuller said the larger carriers are what drive the trucking equipment market.

“Those are the businesses which have bought the brand new equipment and are those that go to sell them in a three- to five-year time-frame,” Fuller said. “I actually wouldn’t exit and recommend anyone buy anything without delay.”

Intermodal rates will rise when truckload rates recuperate

Fuller said when spot rates are as little as they are actually, many shippers move their freight away from intermodal and make the most of lower truckload prices.

“Once we see spot rates rise, that’s once you will begin to see pressure on intermodal rates,” he said.

Fuller and Strickland also said intermodal rates depend upon a few of the biggest lanes within the country, equivalent to from the Port of Los Angeles to Chicago.

“That lane is suffering not only due to loss in demand, however the market share loss,” Strickland said. “Until those trends change, intermodal prices are going to remain, probably moving in alignment with the trucking sector.”

Federal Reserve unlikely to pause raising rates of interest

Fuller said he doesn’t foresee any scenario by which the Federal Reserve will pause raising rates of interest, which some economists consider could help spur consumer spending.

The Fed raises its key rate to extend the price of mortgages, auto loans, bank card borrowing and business loans. By making borrowing costlier, it seeks to slow growth and inflation. Federal Reserve officials have raised the benchmark rate to about 5.1%, a 16-year high.

“A number of the reports suggested that the Federal Reserve remains to be talking about fighting inflation, that they don’t see signs that inflation goes away,” Fuller said. “I feel lots of what’s driving kind of a one-track mind contained in the Federal Reserve are the employment numbers, by way of driving inflation. I feel due to that, I find it hard to consider that they will signal that they will loosen monetary conditions.”

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.