As the worldwide trade recession began to materialize in 2022, there was a fantastic deal of hype over the potential boost to ocean container demand once the Chinese government ended its COVID restrictions and lockdown measures. But now that hype has faded and what was once hoped to be a fantastic reopening and much-needed boost to volumes is looking increasingly more like a fantastic flop.

Within the chart above, the Inbound Ocean TEU Volume Index from China to the U.S. provides a seasonality view that compares 2023 volumes so far (white line) with volumes over the past 4 years. It was late March/early April of 2022 (green line) when the Chinese government announced one other round of COVID restrictions and lockdowns. This latest round of lockdowns at first appeared as in the event that they would make the transportation of products to and from major manufacturing hubs nearly not possible. That caused some to mechanically (and haphazardly) assume the next scenario: The lockdowns would cause a backlog of products and pent-up demand that might eventually cause one other container surge much like what occurred after the primary round of lockdowns in 2020. But we were in a position to see a unique story playing out in real time through our bookings data.

Those that were expecting an impending freight surge hadn’t realized that, regardless that access to the Port of Shanghai was largely blocked as a consequence of landside restrictions (i.e., road closures), shippers were in a position to reroute volumes through the closest alternate major port in nearby Ningbo. Because the chart above clearly displays, the resulting decline in Shanghai bookings and container volumes was greater than offset by a surge of volumes through Ningbo during that point (from the rerouted Shanghai bookings).

Because the yr progressed into the second half, global container volumes began plummeting, and there have been still no signs of a surge in volumes coming out of China. Because the hopes of a possible freight wave eventually began to fade, it was still widely believed that China’s reopening would (at the least) be a significant factor in helping boost volumes and possibly create a “soft landing” for the worldwide ocean container market. Unfortunately, that boost in volumes never appeared. As an alternative, volumes continued to melt out of China during a largely nonexistent peak season. The weakening volumes were then met by emerging headwinds resembling the inventory glut, weakening consumer demand and increasingly negative economic landscape.

That trend has continued through Q1 of 2023, and now, it’s becoming increasingly clear that hopes of a reopening container boost are all but gone. While April saw China’s share of U.S. imports bounce back up 6% month over month to 37% (chart above), this small bump in volumes isn’t more likely to turn into a sustained trend, and there are actually a growing variety of signals flashing red inside Chinese government-reported economic data in addition to commodity markets. The next signals needs to be heeded as a warning that the road ahead could worsen for China.

Currently, the inventory destocking phase (and when it’ll be complete) is one of the crucial vital challenges facing China to U.S. container demand and was discussed at length by the CEO and CFO of Maersk within the ocean carrier’s most up-to-date earnings call. To raised understand the phases of the inventory replenishment cycle, we are able to examine average container volume (in twenty-foot equivalent units) per booking from China to the U.S. The chart above displays the monthly average of TEUs per booking from January 2022 through today. This has been a key indicator of the varied stages of the replenishment cycle — and was a critical component of why import demand was dripping off a cliff in mid-2022. In this ratio, we were in a position to see that importers (i.e., Samsung) were cutting purchase order quantities in a way they thought would end in largely the identical variety of bookings, just less overall TEU volume per booking. The signal for a brand new replenishment cycle for U.S. importers might be for this ratio to maneuver back above a mean of two TEUs per booking. Currently it resides at its lowest reading since early 2019 at 1.7 TEUs per booking.

With the amount per booking being at its lowest level since COVID began, it’s no surprise that our latest ocean container bookings data for the U.S.-bound container volumes departing China proceed to exhibit the general weakness in U.S. import demand, with any probabilities of a second-half rebound getting increasingly unlikely. This weakness in booking volumes was again echoed in the most recent April contraction of the Caixin China General Manufacturing PMI, which fell unexpectedly to a four-month low of 49.2 in April (and below the midway point of fifty that delineates expansion and contraction). Recent orders fell to 48.8 from 53.6 and buying activity contracted to 48.8 from 53.6, with Chinese firms reporting that delivery times had improved as vendors were less busy.

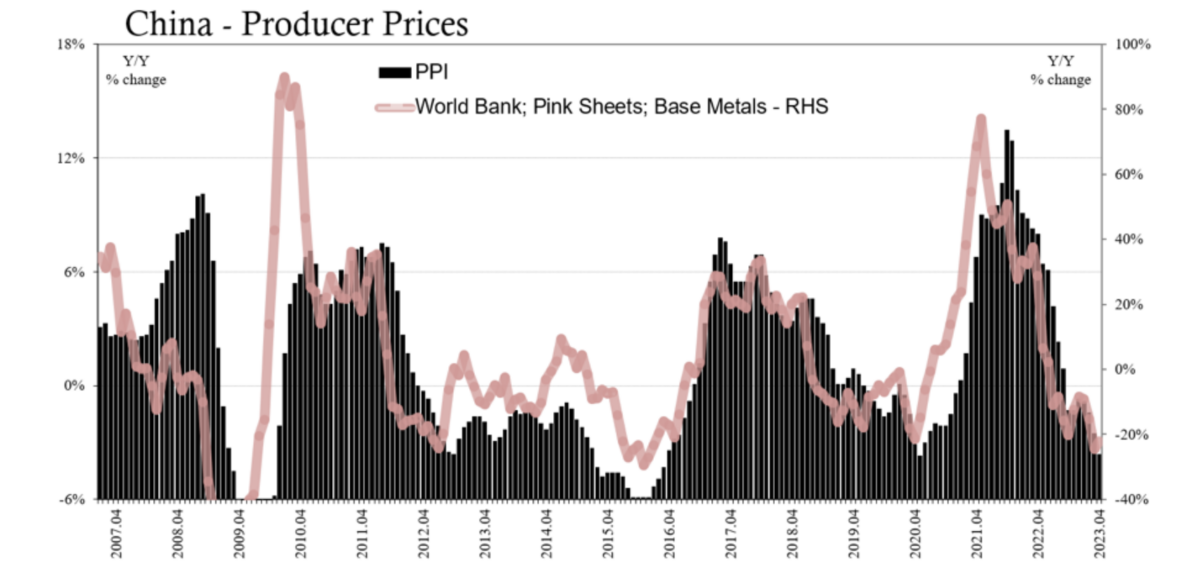

Macroeconomist Jeffrey Snider with Eurodollar University has been following the China economic data closely, and in a recent update he covered the chart above highlighting the tight correlation between the World Bank’s Pink Sheet Base Metals Index Data and the China Producer Price Index stating, “The more severe it gets for China’s factories (because nobody in America or Europe is buying anymore), the more prices are going to fall, starting with commodities. China’s Producer Price Index and factory gate prices each accelerated to the downside in April, meaning much more deflation is on the best way (and that’s not a superb thing). Prices of materials going into China’s factories are falling and costs of stuff coming out are taking place just as fast.”

Imports to China also unexpectedly shrank by 7.9% yr over yr (y/y) to $205.2 billion in April, missing market expectations amid weak consumer demand, lower commodity prices and a stronger dollar. Within the chart above we are able to clearly see the declines in container volumes from all global ports destined for Chinese ports, with the index dropping over 20% (on a moving seven-day average) for the reason that starting of March 2023.

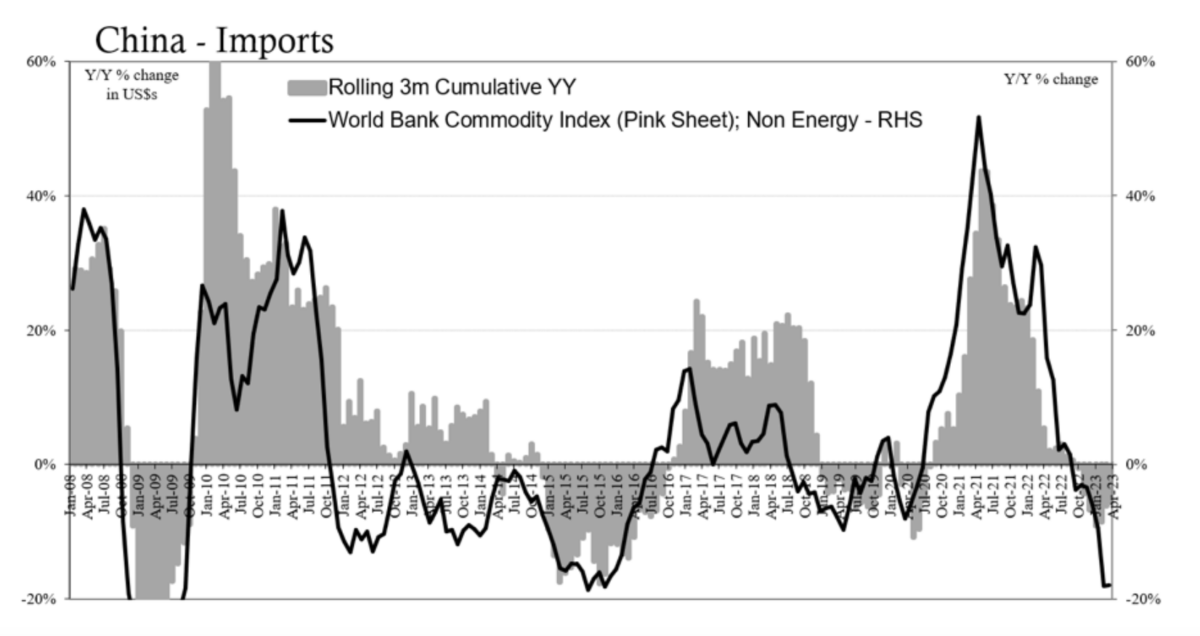

Crude oil imports were down 1.45% y/y to the bottom level since January, purchases of copper fell 12.5% and purchases of iron ore fell 5.1%. Chinese imports from ASEAN countries fell 6.3% and from the U.S. fell by 3.1%. As we are able to see within the chart above, Snider again points out the high correlation between Chinese imports and the World Bank’s index tracking commodity prices. Chinese manufacturing is an infinite source of demand for raw materials, so it is basically no surprise that it has such a good correlation with commodity prices worldwide.

Meanwhile, the recent announcements of OPEC+ production cuts (together with resulting futures price motion) serves as further evidence that the Chinese rebound and reopening isn’t materializing into the surge in oil demand that might be a primary input into a rise in manufacturing and production inside China’s industrial sector and would even be a key input into a serious surge in Chinese consumer demand inside the services sector. The chart above represents the subsequent 4 months of WTI crude oil futures, which all saw further declines on Friday, again confirming that the market is watching the balance of supply against the increasing demand headwinds and economic concerns facing each China and the U.S.

It’s now becoming increasingly clear that the China reopening isn’t more likely to cause a surge in container volumes anytime soon. These key economic indicators for Chinese manufacturing don’t paint a fairly picture for the ocean container market within the second half of 2023 and are especially concerning for U.S. containerized import volumes.

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.