Flatbed truckload carrier Daseke pointed to an absence of a seasonal uplift as the idea for lowering its full-year outlook on Tuesday.

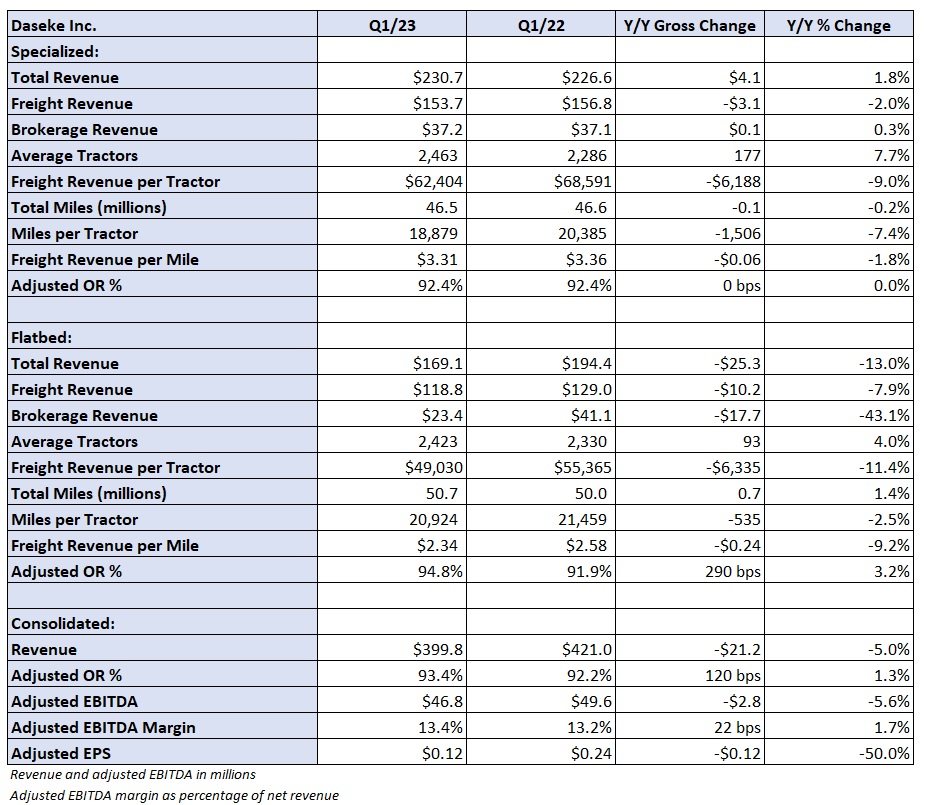

The corporate reported first-quarter adjusted earnings per share of 12 cents before the market opened, which was double the consensus estimate but half the year-ago mark. Following the quarter end, the corporate repaid $50 million in debt and redeemed $20 million in preferred shares. Those actions are expected to contribute 11 cents in adjusted EPS annually.

Net interest expense was up slightly greater than $4 million yr over yr (y/y) within the period despite the fact that debt was largely flat. The result was roughly a 7 cent headwind to EPS.

Daseke (NASDAQ: DSKE) reeled in guidance as there is no such thing as a “clear visibility” right into a recovery and because it not expects a seasonal lift in freight volumes within the spring-summer timeframe. Revenue is forecast to say no 5% y/y during 2023 as rates experience one other 1% to 2% decline.

Adjusted earnings before interest, taxes, depreciation and amortization is now forecast in a spread of $210 million to $220 million versus the quarter-ago guide of flat y/y at $235 million. Adjusted EBITDA was down 6% y/y in the primary quarter to $47 million.

“There’s a number of data points on the market that we’re . … We’re just not likely seeing the seasonal uplift,” CEO Jonathan Shepko told analysts on a call.

He said rates normally move 10% to fifteen% higher from March to April but that isn’t the case this yr because the industry continues to be establishing a bottom for pricing.

Consolidated revenue declined 5% y/y to $400 million. Daseke is using the looser market to maneuver more freight on company-owned equipment, which produces a greater margin profile in comparison with loads moved by owner-operators. Across each of its fleets, loads hauled on company trucks increased 4%.

The corporate’s specialized unit reported a 2% y/y increase in revenue to $231 million. Average tractors in use increased 8% but freight revenue per tractor was off 9%. Owner-operators made up lower than 18% of the fleet within the quarter, which was 360 basis points lower y/y.

Miles per tractor were down 7% y/y as the corporate saw good demand within the agricultural and energy markets, which was offset by weaker construction and manufacturing activity. Freight revenue per mile declined 2% to $3.31.

The corporate’s general flatbed unit recorded a 13% y/y decline in revenue to $169 million. Freight revenue was down just 8% but brokerage revenue fell 43% as the corporate took higher-paying loads from its brokerage business and moved them on company equipment.

Freight revenue per tractor was down 11% y/y as rate per mile fell 9% to $2.34 and miles per tractor declined 2.5%. The share of owner-operators was reduced by 480 bps within the quarter.

On a consolidated basis, Daseke posted a 93.4% adjusted operating ratio, 120 bps worse y/y. Salaries, wages and advantages increased 320 bps as a percentage of revenue. Stock-based compensation was a headwind. Purchased transportation was down 460 bps as a consequence of the lower brokerage volumes and better usage of company trucks.

The corporate has several operational initiatives in place to enhance operating income by greater than $25 million. The total realized run rate on these process changes and price programs must be in place by the center of next yr and potentially as high as $30 million by the tip of 2024.

Daseke reported liquidity of $196 million following the debt repayment and share redemptions. It generated money flow from operations of $31 million within the quarter. Total debt of $619 million was 2.7x adjusted EBITDA, down barely from yr end. The corporate reiterated a long-term leverage goal of 1.5x to 2x.

Net capital expenditures guidance for 2023 was lowered by $10 million at each end of the brand new range of $135 million to $145 million.

Shares of DSKE were off 13% at 1:41 p.m. Tuesday in comparison with the S&P 500, which was down 0.3%.

Evidence of a second half recovery not appearing

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.