An unusually broad-based downturn in goods flows that has affected even probably the most resilient of customer segments — consumer packaged goods and food and beverage — has freight brokers scrambling to distinguish themselves and compete for less available freight.

Tyson Foods’ stock plunged by greater than 16% after it announced that it lost money in the primary quarter of 2023, couldn’t manage to grow beef and pork volumes even after cutting prices and lowered its estimates for revenue growth to “flat to 1%” for the yr.

In line with one broker who spoke to FreightWaves, a big food conglomerate is moving 8-10% fewer loads just by consolidating smaller shipments into full truckloads; a decrease in vendor order flow was answerable for an extra 5-7% reduction in volume.

One other freight broker said that lots of the shippers who led the charge to push contract rates down in 2022 at the moment are slowing the pace of their RFPs and searching to lock of their savings long run.

“I have a look at the bid cycle like an accordion,” said Pat Gillihan, chief revenue officer at Transportation One, a Chicago-based freight brokerage. “It completely contracted from annuals to semiannuals to quarterlies as a way to capture the market movements on the upswing and now on the downswing. Now that accordion is being tremendously prolonged: Quarterlies at the moment are semis, semis at the moment are annuals. It suggests that the shippers have realized they’ve captured the underside of the market and need to extend those low rates.”

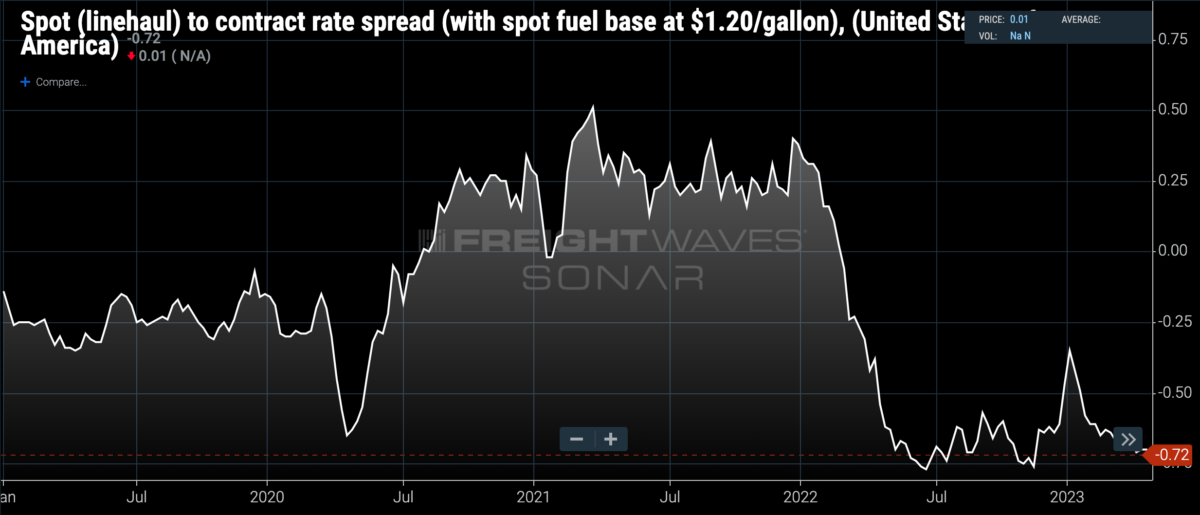

Typically, spot rates stay inside about 25 cents per mile of the prevailing contract rate. If spot rates exceed the contract rate by way more than that, shippers begin to feel the bite of tender rejections and lift their rates to make sure compliance. Historically, if spot rates dropped below contract rates by way more than 25 cents per mile, shippers would get monetary savings by moving their freight on the cheaper spot market until they contracted carriers lowered rates.

Today, spot rates are an incredible 72 cents per mile below contract rates, when including a fuel surcharge of $1.20 per mile. That implies that shippers should give you the option to extract further concessions from their contracted carriers in the event that they so select. Some shippers are still steadily rebidding their freight down, but others have moved on to other priorities, including service.

Gillihan said that shippers are enforcing the best service standards they will — and dinging their carriers and suppliers with fines more steadily when shipments don’t go exactly in line with plan.

“For those who’re not executing at a 98.5% service level or above, you’re being ousted from the network,” Gillihan said. “It’s not even a subject of conversation, just an expectation. The appliance of fees has also increased. We see more $250 chargebacks and $500 fees [for late or incomplete shipments]; things that big box retailers would have let slide previously at the moment are triggering fees.”

Demand softness has began working its way up the provision chain from the retailers to their food and beverage vendors to the businesses that make packaging like cardboard boxes. Packaging Corp. of America, the third-largest containerboard/box producer in North America, which experienced a 13% year-over-year decline in box shipments in the primary quarter, announced Tuesday that it was idling its containerboard plant in Wallula, Washington, indefinitely, and laid off lots of of employees.

To the extent that CPG and food and beverage shippers are on the lookout for latest transportation providers, they’re focused on asset-based trucking carriers, not necessarily third-party logistics providers. That’s modified the best way some freight brokers sell their services.

Gillihan said that at Transportation One, he goes to market with a “strategic capacity-based sales model.” He works closely with the very best small and midsized trucking carriers that he can find and tries to plug the holes of their networks where they need freight. That strategy lowers Transportation One’s cost to serve its customers and makes its capability stickier in those lanes.

Gillihan said leading with the very best carriers helped Transportation One hit 24.7% year-over-year volume growth in the primary quarter of 2023, numbers that many larger 3PLs would struggle to place up on this market.

Echo Global Logistics, a Chicago-based 3PL with $3.75 billion in 2022 gross revenue, has leaned even further into assets in a bid to distinguish itself. Echo, now a personal company since its acquisition by The Jordan Co. in November 2021, is within the technique of rethinking itself as a supply chain solutions provider. That features purchasing real assets.

In May 2022, Echo bought Roadtex Transportation, which operates a nationwide network of 32 cold chain warehousing facilities and a small less-than-truckload fleet. Roadtex’s predominant hubs are in Latest Jersey, Indianapolis and Chino and Sacramento, California. Roadtex’s Indianapolis presence includes greater than 1 million square feet of temperature-controlled warehousing. That permits Echo to get in even deeper with midsized food and beverage and pharmaceutical shippers.

In January of this yr, Echo hired Frank Hurst, a longtime LTL veteran, from Roadrunner to run LTL and now temperature-controlled logistics at Echo. Hurst’s vision is for Echo to integrate its services and change into a single-source solution provider for temperature-controlled logistics.

“When talking to customers, COVID is within the rearview mirror for them, [in terms of] the provision chain disruptions and repair impacts,” Hurst said. “Their expectation is that their service providers get back to providing the best level of service, and we discuss this with our LTL carriers, specializing in on-time service and quality. Our customers don’t want the reasons of driver shortages and provide chain disruptions — they need fluidity and on-time delivery.”

Less-than-truckload rates have come down some as customers rebid freight but LTL pricing is “more rational” than truckload pricing, Hurst said, explaining that LTL carriers are tied to physical real estate like cross-dock facilities and the employees in them, which also constrains where their fleets can construct density. That implies that LTL rate increases will be more tied to macroeconomic inflation than the boom-and-bust cycles of a volatile market like truckload freight.

Hurst said that Echo’s ability to offer critical points of the storage and distribution of temperature-controlled freight helps its CPG customers meet the demands of massive box retailers.

“That linkage is critical,” Hurst said. “Retailers are the distribution channel for CPG and food and bev, and shipping into mass merchants requires a heightened level of service, planning, details and adaptability. That’s why shippers which have temperature-controlled needs partner with a Roadtex or Echo — understanding those requirements will be daunting.”

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.