A growing in-orbit servicing opportunity is tempting satellite builders to branch out of communications, imagery, and other standard fare to get a foothold on this emerging market.

To date this yr, Astroscale, Starfish, and Clearspace have raised around $119 million in total for his or her in-orbit servicing ventures, all from early-stage investors confident enough of their prospects to shrug off difficult macroeconomic conditions.

And after helping pioneer the satellite life extension a part of this market with two ongoing missions in geostationary orbit (GEO), Northrop Grumman plans to deploy a more elaborate robotic servicer next yr to expand its capabilities significantly.

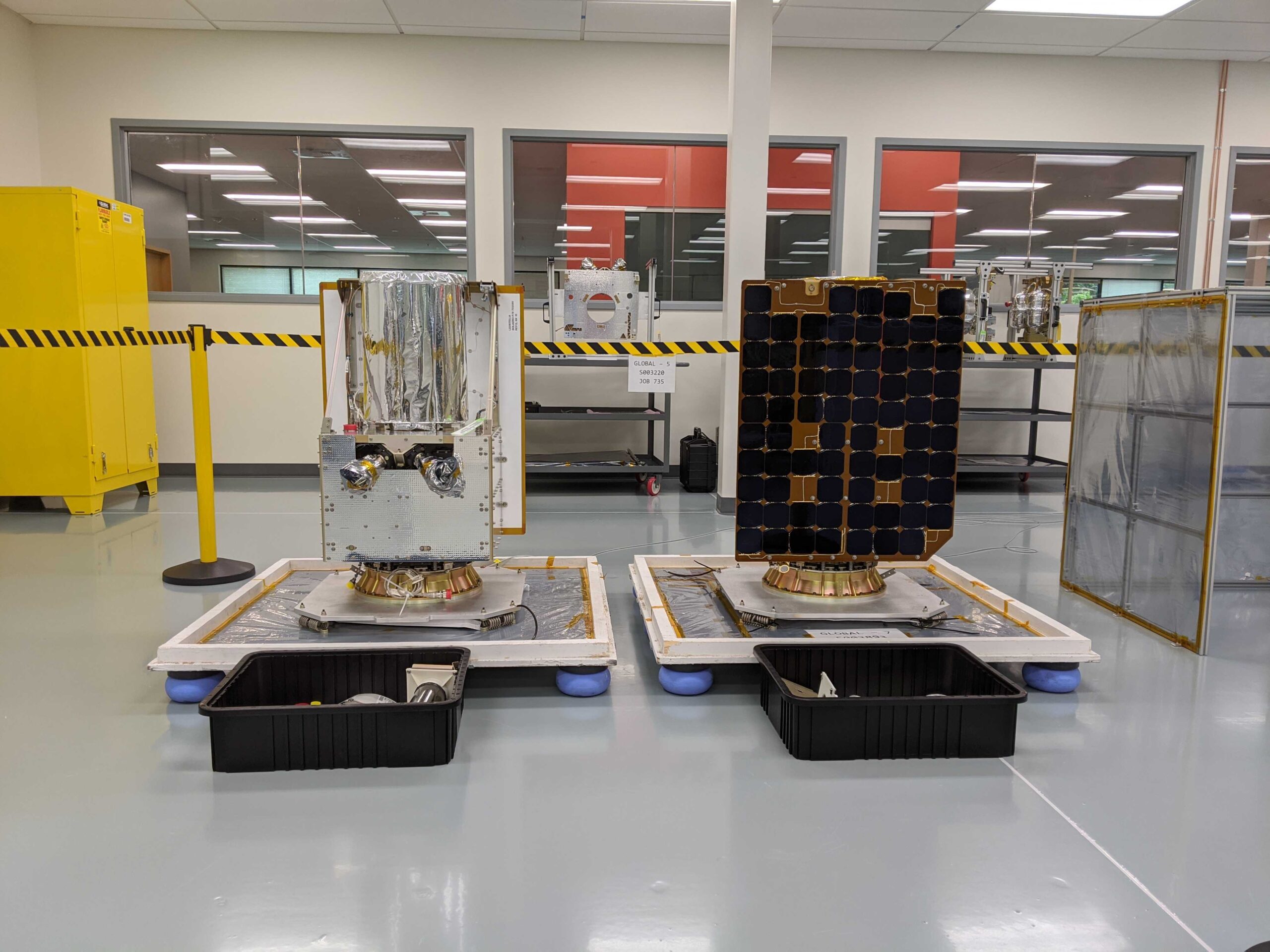

LeoStella, which mostly builds low Earth orbit (LEO) distant sensing satellites and primarily for its part-owner BlackSky, is watching the growing activity with a keen eye, to date from the sidelines.

“There’s no person that has an off-the-shelf industrial solution yet,” LeoStella business development vp Mike Kaplan said, “so, in fact, it’s tempting as a satellite builder.”

He said LeoStella is open to partnering with an organization that would use the up-to-500-kilogram buses it builds for LEO for a satellite life extension business in GEO.

“The best way that we have a look at that business is we see the fundamental vehicle as a normal smallsat bus that we make,” he said, “and we see the robotics, the sensor suite for proximity operations for rendezvous, capture — all that as a part of the payload.”

LeoStella has “been in contact with some firms which might be interested by pursuing this business,” Kaplan added, “so we’re starting to check out it.”

But while LeoStella has 19 satellites in orbit after ranging from scratch five years ago, Kaplan noted moving to GEO and into servicing could be an enormous leap for the corporate.

Demand can also be not quite there yet for an organization that makes a speciality of constructing constellations of satellites.

LeoStella would want to see a necessity for five to 10 life-extending servicers, in response to Kaplan, and while there’s interest on the market, he said, “I haven’t seen something put in front of me yet that claims it’s quite ready for primetime.”

“It’s almost there,” he added, “I mean, it may very well be six months or a yr away.”

Astranis already builds small GEO satellites with a mass of under 400 kilograms for communications customers. It plans to bring its first spacecraft into service later this yr following an April 30 Falcon Heavy launch.

Nonetheless, while in-orbit servicing presents an interesting diversification opportunity, Astranis CEO John Gedmark said it will not be one the corporate is actively pursuing.

Still, there are greater than 130 firms trying to play a job in in-orbit servicing, in response to Joseph Anderson, vp of operations and business development for Northrop’s satellite servicing subsidiary SpaceLogistics.

In the course of the Space Symposium in Colorado Springs, Anderson said the variety of firms has been accelerating due to growing government support for more in-orbit capabilities and work to standardize and regulate the market.

The 2 aging Intelsat satellites SpaceLogistics’ Mission Extension Vehicles are currently attached to were built independently of any future servicing possibility.

Nonetheless, Anderson said starting in 2025 or 2026, he believes all latest satellites must be starting to incorporate items that make them easier to be serviced, “starting with things akin to refueling ports, or power and data ports, in order that they may be repaired or upgraded over time.”

For Starfish CEO Trevor Bennett, “what is actually changing the sport here is that there’s a trust that’s starting to accumulate” within the industry.

As multiple providers come into this market with their very own solutions, he said satellite operators would soon have the ability to depend on an ecosystem of servicers relatively than having to bank on the success of 1 company.

That said, only a few missions have actually flown thus far, and this emerging market’s success stays highly depending on the best mixture of successful technology, policy, and economics.