Last week, we forecast an extra decline in U.S. containerized import volumes within the second half of 2023, and a “recent” bottom for volumes during this downcycle. The lingering effects of the “bullwhip effect” on inventories, together with the considerable downside risks that exist to consumer spending, the upcoming months are prone to witness an unprecedented level of caution amongst importers during this yr’s peak season. This caution, combined with a weakening global macroeconomic backdrop, only heightens the risks of declining import volumes.

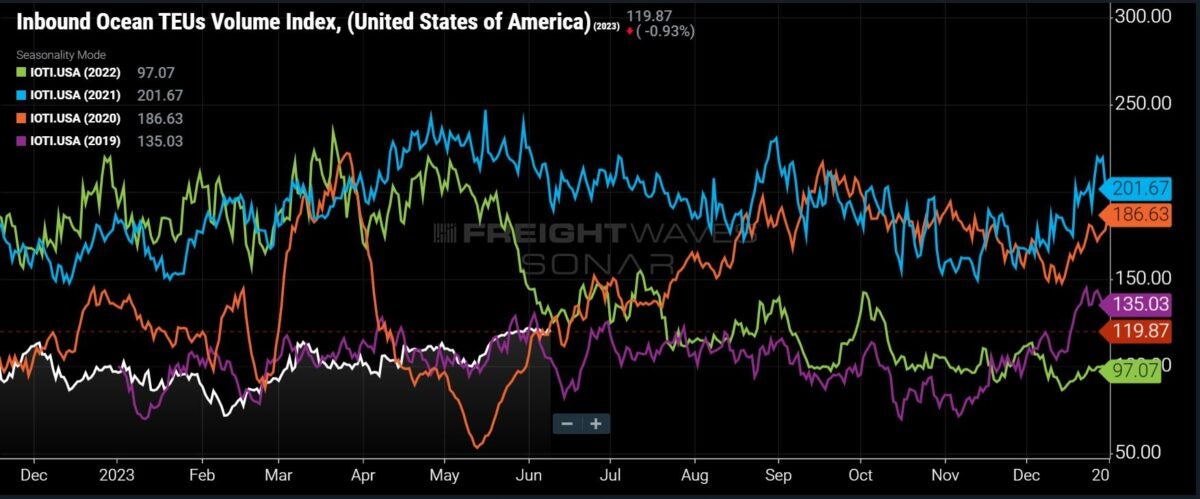

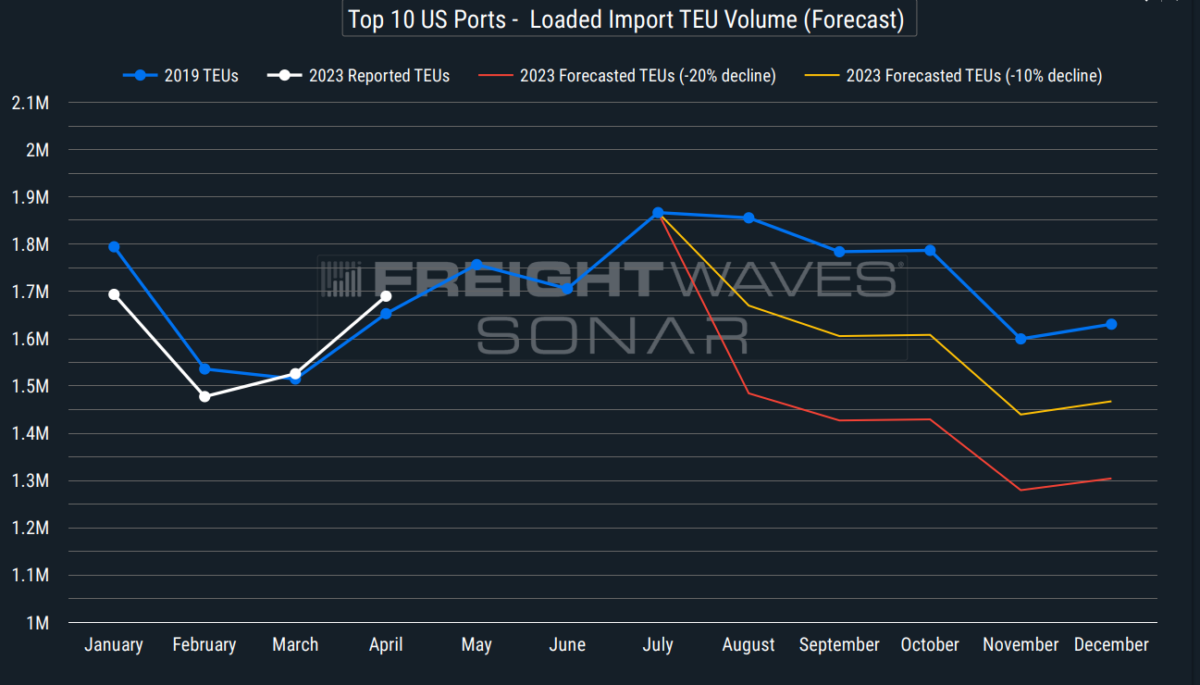

As we forecast, ocean container bookings in the primary half of 2023 (white line) have continued trending right alongside 2019 levels (orange line). This is predicted to proceed through early Q3, at which point we are going to likely begin to see a detaching from 2019 levels to seek out a “recent” bottom, ultimately leading to a big drop of 10% to twenty% below levels experienced in the course of the 2nd-half of 2019. Below is a chart of what that decline of 10% (orange) to twenty% (red) in monthly loaded import TEUs would seem like across the Top 10 U.S. ports.

Probably the most recent May report from Logistics Managers’ Index (LMI) data highlights a crucial nuance within the persistently high inventories. While the provision chain activity reached an all-time low for the third consecutive month in May, inventory levels also contracted for the primary time because the early days of the pandemic. Nevertheless, despite the fact that inventory levels decreased by 1.5 points to 49.5 (marking the primary time since February 2020 that inventories have entered contraction territory), it’s vital to notice that downstream retail inventories proceed to grow at a rate of 54.4, while upstream manufacturer and wholesaler inventories are contracting at a rate of 46.7, which pulled down the general figure for May.

With retail inventories still in a period of expansion, retailers which can be major U.S. importers might be expected to adopt a cautious approach as they navigate the surplus inventories which have accrued in the provision chain bullwhip. These retailers have been scaling back since recognizing the inventory issue in Q1 2022, but the truth is that top inventory levels persist and will extend the destocking cycle throughout (not less than) the rest of 2023. This may require importers to be increasingly strategic of their reordering efforts within the second half to stop further inventory buildup and manage costs effectively while addressing any additional shifts in consumer demand.

As a primary example, Goal, one in all the main retail players (and the second-largest U.S. importer of containerized goods) entered 2023 with a way of caution on account of its inventory glut and potential shifts in consumer spending patterns. The corporate’s fiscal yr 2022 report highlighted the challenges posed by rapid changes in consumer preferences and provide chain volatility, necessitating careful inventory planning to attenuate markdowns. In probably the most recent quarter, Goal has now seen each a decline in foot traffic (down 9% y/y) and sales figures (down 5% y/y) as reported by CitiBank analysts, which has likely only increased Goal’s concerns about reordering/restocking. Within the report from CitiBank, which downgraded Goal’s stock price, the Citi analysts also noted other growing concerns for the retailer, similar to the competitive pressure posed by Walmart, which is predicted to proceed gaining market share (largely on account of its strong Grocery segment), potentially impacting Goal’s discretionary sales, which account for 55% of its overall sales. With Goal serving as a primary example of the problems that major retailers are potentially facing heading into the second half of 2023, it’s becoming increasingly evident why the corporate could be incredibly cautious with bringing in recent container volumes.

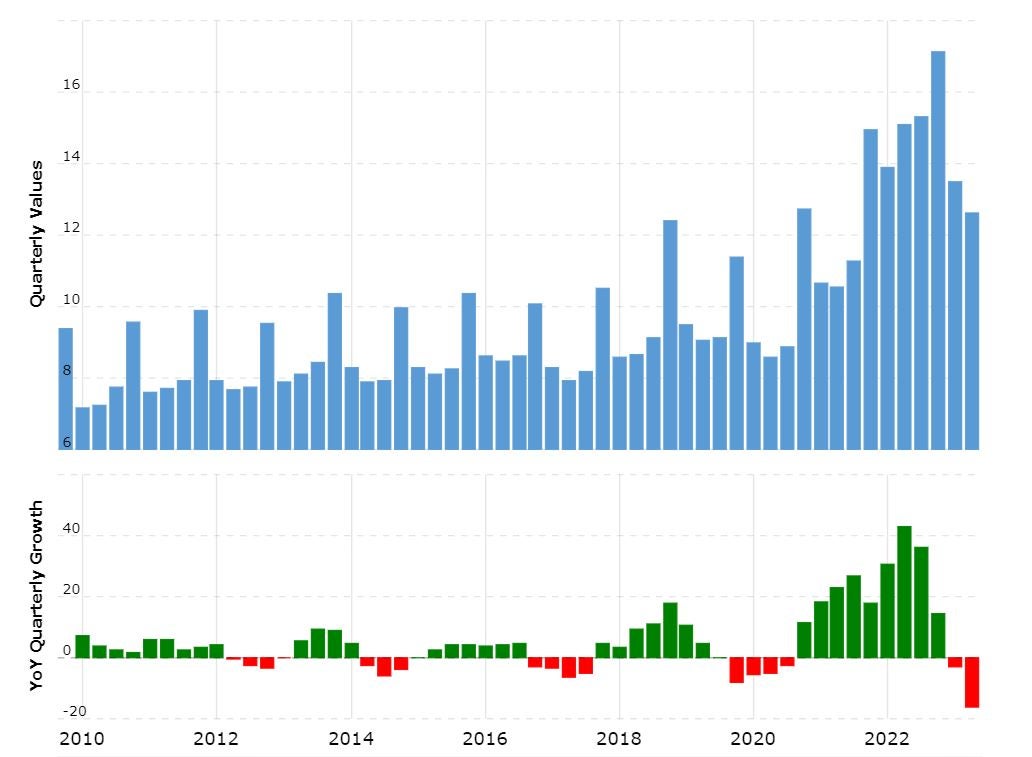

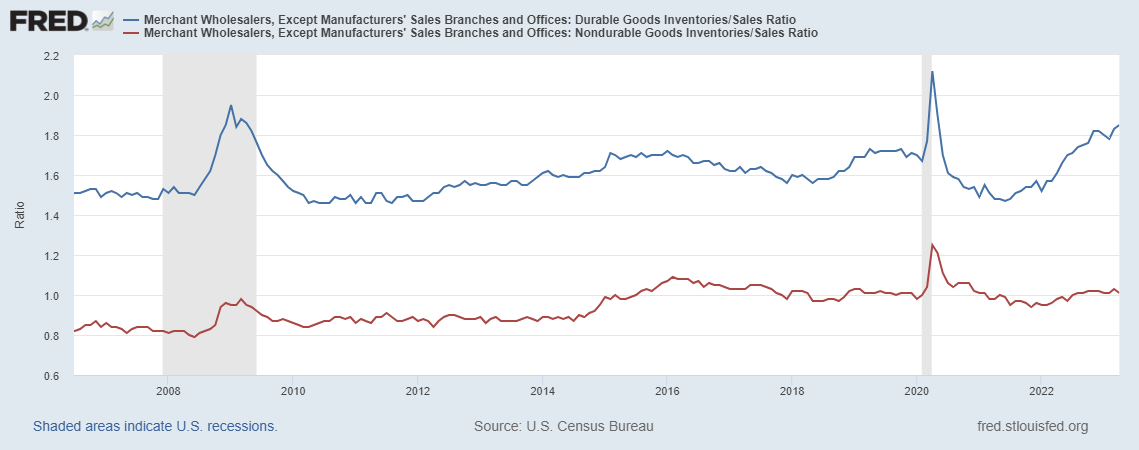

Looking just a little further upstream, wholesalers are also facing larger inventory problems than could also be perceived from solely probably the most recent LMI report. Since November 2022, the inventory-to-sales ratio has been higher than in the course of the worst months of the Great Recession. If sales don’t rebound (increasingly unlikely that they may), inventories must undergo substantial reductions within the second half. The imbalance between excessive inventories and only a slight softening of sales is causing significant strain throughout the worldwide supply chain, especially on the subject of major origin countries and production centers for U.S. containerized goods.

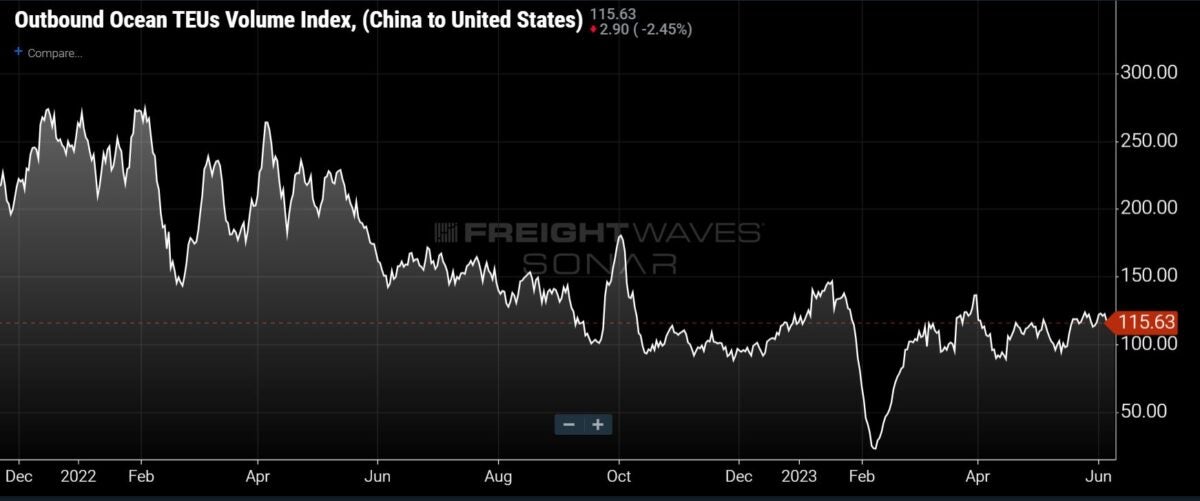

This strain is becoming increasingly apparent further upstream into major origin countries for U.S. containerized imports like China, where economic troubles proceed to worsen. Jeffrey Snider of Eurodollar.University has been covering this in-depth in recent weeks, and in a recent video post, he identified that for the fourth consecutive month, consumer prices have dropped alongside the biggest year-on-year decline in Producer Price Index (PPI) and factory gate prices since 2016. Within the chart below, we are able to see that in May alone, China’s producer prices experienced a big 0.9% decrease, further confirming that China’s reopening has been significantly overstated. These year-on-year declines are especially concerning given the indisputable fact that these comparisons are being made during last yr when large manufacturing centers in China (i.e. Shanghai) were still largely on lockdown on account of COVID restrictions.

Snider also identified that China’s economic woes are reverberating throughout Asia, driven by the worldwide recession that has dragged down industries. This widespread contraction is clear within the sharp decline in imports from South Korea and Japan, with each countries experiencing a 26% year-to-date decrease in imports. There has also been a considerable decline in China’s exports. Specifically, the worth of products exported to the U.S. plummeted by 18% yr on yr in May. That is all supportive of the truth that the reverse bullwhip effect has dealt a big blow to China, resulting ultimately in lower prices while intensifying the worldwide trade recession, which has spread deeper into Europe.

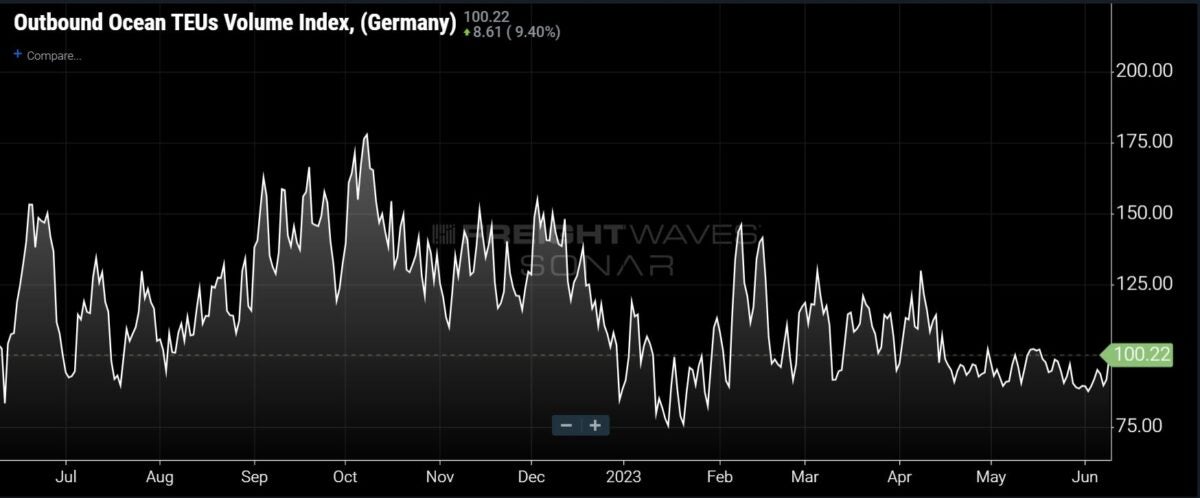

Europe’s PPI has sharply declined, primarily on account of falling energy prices, but included a substantial decline in core prices as well. The HCOB Flash Manufacturing PMI for the Eurozone in May 2023 recorded a big decline to 44.6 from April’s 45.8, far below the forecasted 46.2. This reading indicates the sharpest contraction within the factory sector in three years, with output, recent orders, and backlogs of orders all declining at an accelerated pace. Input prices experienced probably the most substantial drop since February 2016, as manufacturers curtailed their input purchases, resulting in a steep decline in inventories. Business confidence, especially inside the manufacturing sector, weakened further, and Germany (already in an official recession) witnessed a very pronounced decline in manufacturing activity. Factory orders there have plummeted, especially from non-European markets, further indicating weakening global demand.

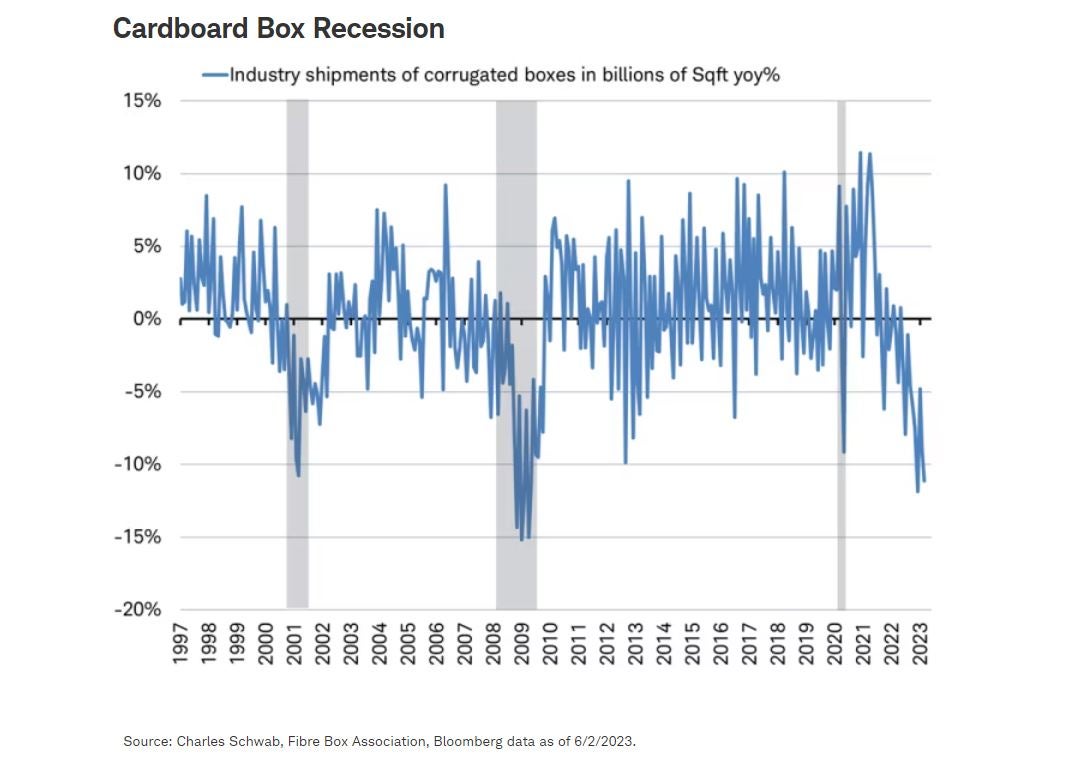

It is usually vital to notice one other major input within the manufacturing process: cardboard box demand. FreightWaves was among the many first to cover the concerning signs surrounding cardboard box demand within the article, “Cardboard box demand plunging at rates unseen because the Great Recession.” Demand has remained soft ever since, and in a recent article from Charles Schwab’s chief global investment strategist, Jeffrey Kleintop, he proclaimed that the US is currently experiencing a “cardboard box recession.” This refers to a situation through which manufacturing and trade experience a worldwide recession while services industries proceed to grow. Demand for manufacturing and trade-related goods has declined, as indicated by the decrease in demand for corrugated linerboard.

Circling all the best way back to consumers, there are still plenty of downside risks facing consumer spending within the 2nd-half, but one in all the biggest risks is student loan repayments. FreightWaves CEO Craig Fuller covered this risk at length in his recent article “An unusually terrible freight market may get so much worse.” The article points out aspects that would worsen the freight market, including the potential end of assorted stimulus programs which have boosted personal income and freight demand, but specifically, it highlights the potential fallout attributable to the approaching resumption of student loan payments.

The top of the coed loan deferment program, which allowed consumers to save lots of a mean of over $15,000 since March 2020, can have a big impact on consumer spending. With 64% of the $1.7 trillion student loan debt remaining in forbearance, the resumption of payments will create a money flow shock for a lot of households, particularly among the many 25 million Americans ages 18-44 who’ve deferred their payments. This demographic plays a vital role in driving consumer spending, and the sudden increase of roughly $393 monthly in loan payments will likely result in reduced discretionary income and a possible decrease in spending capability.

The lingering effects of the “bullwhip effect” on inventories at major U.S. importers, together with the considerable downside risks that exist to consumer spending, the upcoming months are prone to witness an unprecedented level of caution amongst importers. The prevailing global economic conditions further contribute to the downward risks facing import volumes. While it might not be a pointy drop, it’s becoming increasingly probable that U.S. import demand will experience a fresh decline and establish a brand new low point within the second half of 2023.

Way forward for Supply Chain

JUNE 21-22, 2023 • CLEVELAND, OH • IN-PERSON EVENT

The best minds within the transportation, logistics and provide chain industries will share insights, predict future trends and showcase emerging technology the FreightWaves way–with engaging discussions, rapid-fire demos, interactive sponsor kiosks and more.